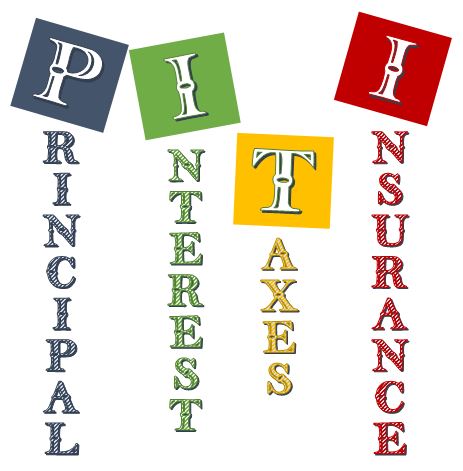

PITI (Principal, Interest, Taxes, and Insurance) – Planning to buy a home, you need to know how much you can afford to pay each month. One way to estimate your monthly mortgage payment is to use the acronym PITI, which stands for principal, interest, taxes, and insurance. These are the four main components of a mortgage payment that affect your budget and eligibility for a loan.

The four components of a monthly mortgage payment. PITI helps both the buyer and the lender determine the affordability of a mortgage loan. It also affects the borrower’s front-end and back-end ratios, which are used to approve mortgage loans.

In this article, we will explain what each component means, how to calculate them, and how they affect your loan approval and affordability.

READ ALSO

- Term Life Insurance – What it is and how does it Work

- Do You Need a Brokerage Account to Buy Stocks?

- Best Cloud Storage Solutions for Small Business In 2023

- PITI (Principal, Interest, Taxes, and Insurance)

- Best Accounting and Payroll Software for Small Business in 2023

- What Is Insurance Deductible (Complete Overview)

- Best Free Online Savings Accounts of 2023

Principal

The principal is the amount of money borrowed from the lender to buy the home. It is usually equal to the sale price of the home minus the down payment. For example, if you buy a home for $200,000 and put 5% down ($10,000), then your principal is $190,000.

Every month, a portion of your mortgage payment goes toward reducing the principal balance. The principal repayment reduces your debt and increases your equity in the home. The faster you pay off the principal, the less interest you will pay over the life of the loan.

Interest

Interest is the cost of borrowing money from the lender. It is expressed as an annual percentage rate (APR) that is applied to the outstanding principal balance. For example, if your APR is 6% and your principal is $190,000, then your monthly interest payment is $950 ($190,000 x 0.06 / 12).

The amount of interest you pay each month depends on the type and term of your loan. Fixed-rate loans have a constant interest rate and monthly payment for the entire loan term. Adjustable-rate loans have a variable interest rate and monthly payment that can change periodically based on market conditions. Interest-only loans allow you to pay only interest for a certain period of time before you start paying principal.

Taxes

Taxes are the property taxes levied by local governments to fund public services such as schools, roads, and emergency services. Property taxes are usually based on a percentage of the assessed value of your home. For example, if your home is worth $200,000 and your property tax rate is 1%, then your annual property tax bill is $2,000 ($200,000 x 0.01).

Property taxes are usually paid in installments throughout the year. You can choose to pay them separately or include them in your monthly mortgage payment. If you choose the latter option, your lender will collect and hold your tax payments in an escrow account until they are due.

Insurance

Insurance refers to two types of coverage that may be required when you have a mortgage: homeowners insurance and mortgage insurance.

Homeowners insurance protects your home and its contents from fire, theft, vandalism, and other perils. It also covers your liability if someone gets injured on your property or sues you for damages. Homeowners’ insurance premiums vary depending on factors such as the value, location, and condition of your home, as well as the coverage limits and deductibles you choose.

Mortgage insurance protects the lender in case you default on your loan. It is usually required if your down payment is less than 20% of the home price. There are two main types of mortgage insurance: private mortgage insurance (PMI) for conventional loans and mortgage insurance premium (MIP) for FHA loans. Mortgage insurance premiums are either paid upfront or added to your monthly mortgage payment.

PITI Formula

To calculate your PITI payment, you need to add up the four components using this formula:

PITI = Principal + Interest + Taxes + Insurance

For example, if your principal is $190,000, your interest rate is 6%, your property tax rate is 1%, your homeowners’ insurance premium is $800 per year and your mortgage insurance premium is $100 per month, then your PITI payment is:

PITI = ($190,000 / 360) + ($190,000 x 0.06 / 12) + ($200,000 x 0.01 / 12) + ($800 / 12) + $100 PITI = $527.78 + $950 + $166.67 + $66.67 + $100 PITI = $1,811.11

PITI Ratios

Lenders use PITI ratios to measure how much of your income goes toward paying your mortgage expenses. There are two types of PITI ratios: front-end ratio and back-end ratio.

The front-end ratio compares your PITI payment to your gross monthly income (before taxes and deductions). It shows how much of your income is used to pay for housing expenses. Lenders typically prefer a front-end ratio of 28% or lower, meaning that no more than 28% of your income should go toward PITI.

The back-end ratio compares your total monthly debt payments (including PITI) to your gross monthly income. It shows how much of your income is used to pay for all kinds of debt obligations such as credit cards, car loans, student loans, and personal loans. Lenders typically prefer a back-end ratio of 36% or lower, meaning that no more than 36% of your income should go toward debt payments.

To calculate your front-end ratio, you need to divide your PITI payment by your gross monthly income. For example, if your PITI payment is $1,811.11 and your gross monthly income is $6,000, then your front-end ratio is:

Front-end ratio = $1,811.11 / $6,000 Front-end ratio = 0.302 or 30.2%

To calculate your back-end ratio, you need to add up all your monthly debt payments and divide them by your gross monthly income. For example, if your PITI payment is $1,811.11, your credit card payment is $200, your car loan payment is $300 and your student loan payment is $400, then your total monthly debt payments are $2,711.11. If your gross monthly income is $6,000, then your back-end ratio is:

Back-end ratio = $2,711.11 / $6,000 Back-end ratio = 0.452 or 45.2%

How to Lower Your PITI Payment

Lowering your PITI payment can help you save money and improve your cash flow. There are several ways to reduce your PITI payment, depending on your situation and goals. Here are some common strategies:

Refinance your mortgage

When interest rates have dropped since you took out your loan, or if your credit score has improved, you may be able to qualify for a lower interest rate and a lower monthly payment. You can also refinance to a shorter loan term, which will reduce your total interest costs over time, but increase your monthly payment. Use Bankrate’s refinance calculator to see how much you can save by refinancing.

Make a larger down payment

If you can make a bigger down payment, that will help lower your PITI, too, because you won’t need to borrow as much. You can also avoid paying private mortgage insurance (PMI) if you put down at least 20% of the home price. PMI is an extra fee that lenders charge borrowers who have less than 20% equity in their homes. PMI typically costs between 0.5% and 1% of the loan amount per year.

Shop around for homeowners insurance

While you won’t have much control over the property taxes in your area, you can shop around for the best deal on homeowners insurance. Homeowners’ insurance premiums vary depending on factors such as the value, location, and condition of your home, as well as the coverage limits and deductibles you choose. You can compare quotes from different insurers online or through an agent to find the best policy for your needs and budget.

Appeal your property tax assessment

If you think your home is overvalued by the tax assessor, you can appeal your property tax assessment and try to lower your tax bill. You’ll need to provide evidence that your home is worth less than the assessed value, such as recent sales of comparable homes in your area or an appraisal report. The appeal process varies by state and county, so check with your local tax authority for the rules and deadlines.

How PITI Affects Your Loan-to-Value Ratio

Your loan-to-value (LTV) ratio is the percentage of your home’s value that you owe to your lender. For example, if your home is worth $200,000 and your mortgage balance is $160,000, then your LTV ratio is 80% ($160,000 / $200,000). Your LTV ratio affects your interest rate, your eligibility for certain loan programs, and your need for mortgage insurance.

Your PITI payment can affect your LTV ratio in two ways:

- PITI payment influences how much you can borrow. Lenders use your PITI payment to calculate your debt-to-income (DTI) ratio, which measures how much of your income goes toward paying your debts. The lower your DTI ratio, the more you can afford to borrow and the lower your LTV ratio will be.

- PITI payment affects how fast you pay down your principal. The more principal you pay each month, the faster you reduce your loan balance and lower your LTV ratio. You can pay more principal by choosing a shorter loan term, making extra payments, or refinancing to a lower interest rate.

Lowering your LTV ratio can help you save money on interest and mortgage insurance, as well as increase your home equity and borrowing power.

How to Use a PITI Calculator

A PITI calculator is a tool that can help you estimate your monthly mortgage payment, including the principal, interest, taxes, and insurance components. Using a PITI calculator can help you plan your budget, compare different loan options, and determine how much house you can afford. To use a PITI calculator, you need to follow these steps:

- Enter the purchase price of the home you want to buy.

- Enter the down payment amount you plan to make.

- Enter the interest rate and loan term of the mortgage you want to get.

- Enter the annual property tax and homeowners insurance costs for the home. You can find this information from the county website, the real estate agent, or the insurance company.

- Optionally, enter any other fees or costs that may be included in your mortgage payment, such as private mortgage insurance (PMI), homeowners association (HOA) fees, or extra payments.

- Click on calculate to see your PITI payment and how it breaks down into each component.

You can use Bankrate’s PITI calculator to try it out

How PITI Varies by Location and Loan Type

Your PITI payment can vary significantly depending on where you live and what type of loan you choose. Here are some factors that can affect your PITI payment:

Property taxes

Property taxes are determined by local governments based on the assessed value of your home and the tax rate in your area. Property taxes can vary widely by location, even within the same state or county. For example, the average property tax rate in New Jersey is 2.47%, while the average rate in Hawaii is 0.28%. That means a $200,000 home in New Jersey would have an annual property tax bill of $4,940, while the same home in Hawaii would have an annual property tax bill of $560.

Homeowners Insurance

Homeowners insurance premiums are based on factors such as the value, location, and condition of your home, as well as the coverage limits and deductibles you choose. Homeowners’ insurance costs can also vary by location, depending on the risk of natural disasters, crime, and other hazards. For example, the average annual homeowner’s insurance premium in Florida is $2,055, while the average premium in Oregon is $677. That means a $200,000 home in Florida would have a monthly insurance cost of $171.25, while the same home in Oregon would have a monthly insurance cost of $56.42.

Mortgage Insurance

Mortgage insurance is required for borrowers who make a down payment of less than 20% of the home price. Mortgage insurance protects the lender in case you default on your loan. There are two main types of mortgage insurance: private mortgage insurance (PMI) for conventional loans and mortgage insurance premium (MIP) for FHA loans. Mortgage insurance costs can vary by loan type, loan amount, loan-to-value ratio, credit score, and other factors. For example, PMI can range from 0.5% to 1% of the loan amount per year, while MIP can range from 0.45% to 1.05% of the loan amount per year. That means a $200,000 conventional loan with a 10% down payment and a PMI rate of 0.75% would have a monthly PMI cost of $112.50, while a $200,000 FHA loan with a 10% down payment and a MIP rate of 0.8% would have a monthly MIP cost of $120.

As you can see, your PITI payment can change significantly depending on where you buy your home and what type of loan you get. Therefore, it is important to compare different loan options and locations before making a final decision. You can use Bankrate’s PITI calculator to estimate your PITI payment for different scenarios.

How to Budget for PITI Expenses

Budgeting for PITI expenses is an essential part of homeownership. PITI expenses can make up a large portion of your monthly income, so you need to plan ahead and make sure you can afford them comfortably. Here are some tips on how to budget for PITI expenses:

Know your PITI payment

Before you buy a home, use a PITI calculator to estimate your monthly mortgage payment, including principal, interest, taxes, and insurance. You can also ask your lender for a loan estimate, which will show you the projected PITI payment for the loan you are applying for.

Compare your PITI payment to your income

A common rule of thumb is that your PITI payment should not exceed 28% of your gross monthly income. This is known as the front-end ratio, and it helps lenders determine your ability to pay for housing expenses. To calculate your front-end ratio, divide your PITI payment by your gross monthly income. For example, if your PITI payment is $1,500 and your gross monthly income is $5,000, then your front-end ratio is 30% ($1,500 / $5,000).

Consider your other debt obligations

Besides your PITI payment, you may have other debt payments to make each month, such as credit cards, car loans, student loans, or personal loans. These payments affect your back-end ratio, which is the percentage of your income that goes toward paying all your debt obligations. Lenders typically prefer a back-end ratio of 36% or lower. To calculate your back-end ratio, add up all your monthly debt payments and divide them by your gross monthly income. For example, if your PITI payment is $1,500 and your other debt payments are $500, then your total monthly debt payments are $2,000. If your gross monthly income is $5,000, then your back-end ratio is 40% ($2,000 / $5,000).

Adjust your budget accordingly

If your PITI payment and/or your back-end ratio are too high for your income level, you may need to adjust your budget accordingly. You can do this by reducing your expenses, increasing your income, or choosing a more affordable home or loan option. You can also use Bankrate’s home affordability calculator to see how much home you can afford based on your income and debt levels.

In conclusion, PITI is an important concept to understand when you are applying for a mortgage loan. It represents the total monthly cost of owning a home and affects your affordability and eligibility for a loan. By knowing how to calculate and compare PITI payments and ratios, you can make informed decisions about your home purchase and budget.