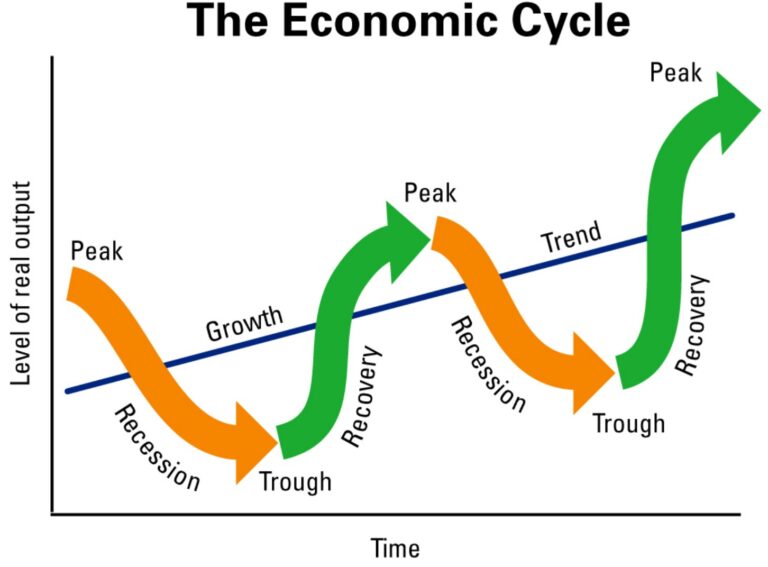

Economic Cycle, also known as the business cycle, is the periodic fluctuation of economic activity around its long-term trend. The cycle involves shifts in the levels of gross domestic product (GDP), employment, income, consumption, investment, and inflation. The economic cycle can affect various sectors of the economy, such as production, trade, finance, and public policy.

It is usually divided into four phases: expansion, peak, contraction, and trough. Each phase has different characteristics and implications for the economy and society.

READ ALSO

- IRS Tax Settlement Attorneys: What You Need to Know

- Gold Investment IRA: What Is It and How Does It Work?

- Maritime Lawyer – All You Need to Know (Educate Yourself)

- Will Car Insurance Cover Stolen Items? – What You Must Know

- Internet Service Provider (ISP) – What It Is and How to Choose the Best

- Car Delivery Insurance Explained: Benefits, Options, and Costs

Expansion

Expansion is the phase of the cycle when the economy grows at a faster rate than its long-term trend. During expansion, output, income, employment, and consumption increase. Businesses invest more in capital goods and inventories to meet the rising demand. Interest rates are generally low, as the central bank stimulates the economy with monetary policy. Inflation may also rise as the economy approaches its full capacity.

Peak

Peak is the phase of the cycle when the economy reaches its highest level of growth and output. During the peak, economic indicators such as GDP, employment, and income are at their maximum levels. However, the peak also marks the end of expansion and the beginning of contraction. The economy may face some imbalances and overheating problems, such as high inflation, trade deficits, asset bubbles, and excessive debt. The central bank may tighten monetary policy to curb inflation and prevent overheating.

Contraction

Contraction is the phase of the cycle when the economy slows down and declines from its peak level. During contraction, output, income, employment, and consumption decrease. Businesses reduce their investment and production as demand falls. Interest rates are generally high, as the central bank tries to control inflation and stabilize the economy. Inflation may also decline as the economy cools down.

Trough

Trough is the phase of the cycle when the economy reaches its lowest level of activity and output. During trough, economic indicators such as GDP, employment, and income are at their minimum levels. However, trough also marks the end of contraction and the beginning of expansion. The economy may benefit from some corrective forces, such as lower prices, lower interest rates, fiscal stimulus, and pent-up demand. The central bank may ease monetary policy to boost growth and recovery.

Causes of Economic Cycles

There are different theories that explain the causes of economic cycles. Some of the main factors that can influence the cycle are:

Demand shocks

These are unexpected changes in aggregate demand that affect the level of output and prices in the economy. For example, a sudden increase in consumer confidence or government spending can boost demand and lead to expansion. Conversely, a sudden decrease in consumer confidence or government spending can reduce demand and lead to contraction.

Supply shocks

These are unexpected changes in aggregate supply that affect the level of output and prices in the economy. For example, a natural disaster or a war can disrupt production and reduce supply, leading to contraction and inflation. Conversely, technological innovation or the discovery of new resources can increase production and expand supply, leading to expansion and deflation.

Financial factors

These are factors related to the financial system and markets that affect the availability and cost of credit in the economy. For example, a financial crisis or a banking panic can reduce lending and increase interest rates, leading to contraction and deflation. Conversely, a financial boom or a credit expansion can increase lending and lower interest rates, leading to expansion and inflation.

Policy factors

These are factors related to the actions of policymakers that affect the level of aggregate demand and supply in the economy. For example, fiscal policy involves government spending and taxation that can stimulate or restrain economic activity. Monetary policy involves central bank actions that influence money supply and interest rates that can affect inflation and growth.

Implications of Economic Cycles

The economic cycle has various implications for different aspects of the economy and society. Some of the main implications are:

- Business implications: The economic cycle affects business performance and profitability. During expansion, businesses enjoy higher sales, revenues, profits, and market share. They also face more competition, higher costs, and more regulation. During contraction, businesses suffer lower sales, revenues, profits, and market share. They also face less competition, lower costs, and less regulation.

- Investment implications: The economic cycle affects investment returns and risks. During expansion, investors tend to favor riskier assets such as stocks that offer higher returns but higher volatility. During contraction, investors tend to favor safer assets such as bonds that offer lower returns but lower volatility.

- Social implications: The economic cycle affects social welfare and well-being. During expansion, people tend to experience higher income, employment, consumption, and happiness. They also face higher inequality, inflation, and environmental degradation. During contraction, people tend to experience lower income, employment, consumption, and happiness. They also face lower inequality, deflation, and environmental improvement.

In Conclusion, The economic cycle is an important concept that helps us understand how economic activity changes over time around its long-term trend. The cycle involves four phases: expansion, peak, contraction, and trough. Each phase has different characteristics and implications for the economy and society. The cycle is influenced by various factors such as demand shocks, supply shocks, financial factors, and policy factors. The cycle has various implications for business performance, investment returns, and social welfare. By analyzing and predicting the economic cycle, we can better prepare for the opportunities and challenges that it brings.

Frequently Asked Questions (F&Qs)

stages of a business

A business goes through various stages in its life cycle. These stages are commonly divided into five phases: launch, growth, shake-out, maturity, and decline.

- Launch: This is the beginning stage of a business where it starts its operations by launching new products or services. Sales are low but slowly increasing and businesses focus on marketing to their target consumer segments by advertising their comparative advantages and value propositions.

- Growth: In the growth phase, companies experience rapid sales growth. As sales increase rapidly, businesses start seeing profit once they pass the break-even point.

- Shake-out: During the shake-out phase, sales continue to increase, but at a slower rate, usually due to either approaching market saturation or the entry of new competitors in the market. Sales peak during the shake-out phase.

- Maturity: When the business matures, sales begin to decrease slowly. Profit margins get thinner, while cash flow stays relatively stagnant.

- Decline or Renewal: In this stage, a business may either decline or renew itself by reinventing and investing in new technologies and emerging markets.

Each stage presents its own challenges and opportunities for a business to grow and succeed.

How many Stages of Economic Growth are there?

According to economist Walt Rostow, there are five stages of economic growth that all countries must pass through to become developed. These stages are 1) traditional society, 2) preconditions for take-off, 3) take-off, 4) drive to maturity, and 5) age of high mass consumption.

What are the 4 causes of economic cycles?

There are several factors that can cause economic cycles. Some of the most common causes include:

- Aggregate demand fluctuations: Fluctuations in aggregate demand can cause an economic cycle that could be persistent.

- Supply-side factors: Factors related to the supply side can also cause economic cycles to shift1.

- Speculative bubbles: This is one of the most common causes of the recession.

- Political business cycles: The elections occur every 4 to 5 years in a democratic country.

These are just some of the factors that can contribute to economic cycles. The causes of a cycle are highly debated among different schools of economics.

What stage of the economic cycle are we in?

According to a recent update from Fidelity, the US is currently in the late-cycle expansion phase of the business cycle, with a rising likelihood of a recession in the second half of 2023. The business cycle has four phases: expansion, peak, contraction, and trough. During the expansion phase, the economy grows at a healthy rate of 2% to 3%, and stocks enter a bull market. During the peak phase, the economy grows by more than 3%, inflation sends prices up, and there are asset bubbles.

What are the 4 stages of the economic cycle?

The four stages of the economic cycle are expansion, peak, contraction, and trough.

- Expansion: During the expansion phase, the economy grows at a healthy rate of 2% to 3%, and stocks enter a bull market.

- Peak: During the peak phase, the economy grows by more than 3%, inflation sends prices up, and there are asset bubbles.

- Contraction: During the contraction phase, the economy slows down and enters a recession. Unemployment rises, and stocks enter a bear market.

- Trough: During the trough phase, the economy hits bottom and begins to recover. Unemployment begins to fall, and stocks begin to rise again.

These stages repeat in a cyclical pattern over time.