In today’s dynamic business landscape, companies are constantly seeking innovative solutions to manage their finances and cash flow efficiently. One such solution that has gained prominence in recent years is Accounts Receivable (AR) Factoring. In this article, we will delve into the world of AR factoring companies, exploring what they are, how they work, and why they are becoming increasingly vital for businesses of all sizes.

Table of Contents

- Understanding AR Factoring

1.1 What is AR Factoring?

1.2 The Role of AR Factoring Companies

- The Mechanics of AR Factoring

- 1 Application and Approval

- 2 Invoice Submission

- 3 Funds Disbursement

- Benefits of AR Factoring

- 1 Improved Cash Flow

- 2 Focus on Core Operations

- 3 Risk Mitigation

- Choosing the Right AR Factoring Company

- 1 Industry Expertise

- 2 Fees and Rates

- 3 Customer Support

- Steps to Start Factoring

- 1 Evaluating Eligibility

- 2 Application Process

- 3 Agreement Terms

- Common Misconceptions

- 1 AR Factoring is a Loan

- 2 It’s Only for Struggling Businesses

- 3 Loss of Customer Control

- Case Studies

- 1 Success Stories

- 2 Real-Life Challenges

- The Future of AR Factoring

- 1 Technological Advancements

- 2 Market Trends

- 3 Expanding Horizons

- FAQs about AR Factoring Companies

- 1 How does AR factoring differ from a traditional bank loan?

- 2 What industries benefit the most from AR factoring?

- 3 Can a startup utilize AR factoring services?

- 4 What happens if a customer fails to pay the factored invoice?

- 5 Are there any upfront costs involved in AR factoring?

Read Also:

Checking Account: A Complete Guide

Best Factoring Company For Trucking in 2023 [FULL LIST]

Understanding AR Factoring

1.1 What is AR Factoring?

AR Factoring, or Accounts Receivable Factoring, is a financial transaction where a business sells its outstanding invoices to a third-party company, known as an AR Factoring Company, at a discounted rate. This enables the business to receive immediate cash, rather than waiting for customers to pay their invoices.

1.2 The Role of AR Factoring Companies

AR Factoring Companies act as financial intermediaries, bridging the gap between businesses and their pending payments. They provide a valuable service by advancing funds against invoices, helping companies maintain steady cash flow.

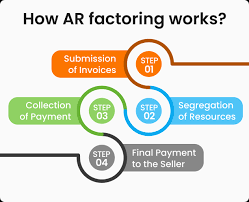

The Mechanics of AR Factoring

2.1 Application and Approval

To get started with AR Factoring, a business submits an application to an AR Factoring Company. The company assesses the creditworthiness of the business and its customers before approval.

2.2 Invoice Submission

Once approved, the business submits its unpaid invoices to the AR Factoring Company. These invoices serve as collateral for the funds advanced.

2.3 Funds Disbursement

Upon verification of the invoices, the AR Factoring Company disburses a significant percentage of the invoice amount to the business. The remaining balance, minus fees, is paid once the customer settles the invoice.

Benefits of AR Factoring

3.1 Improved Cash Flow

AR Factoring significantly improves cash flow for businesses by providing immediate access to funds. This liquidity allows companies to cover operational expenses, invest in growth, and seize new opportunities.

3.2 Focus on Core Operations

By outsourcing the collection of receivables to AR Factoring Companies, businesses can focus on their core operations, rather than chasing unpaid invoices.

3.3 Risk Mitigation

AR Factoring Companies often offer credit risk assessment services, reducing the risk of dealing with customers who may default on payments.

Choosing the Right AR Factoring Company

4.1 Industry Expertise

Selecting an AR Factoring Company with expertise in your industry can prove beneficial. They understand the unique challenges and payment trends specific to your field.

4.2 Fees and Rates

Comparing fees and rates among different AR Factoring Companies is crucial to ensure that the cost of factoring is manageable for your business.

4.3 Customer Support

A responsive and reliable customer support team can make the factoring process smoother for your business.

Steps to Start Factoring

5.1 Evaluating Eligibility

Businesses need to evaluate whether they meet the criteria for AR Factoring, which typically includes having creditworthy customers.

5.2 Application Process

The application process involves providing necessary financial documents and information to the AR Factoring Company.

5.3 Agreement Terms

Understanding the terms of the factoring agreement, including fees, advance rates, and contract length, is essential before proceeding.

Common Misconceptions

6.1 AR Factoring is a Loan

Unlike traditional loans, AR Factoring is not a debt; it’s the sale of assets (invoices).

6.2 It’s Only for Struggling Businesses

AR Factoring is used by businesses of all sizes, from startups looking to expand to established companies managing rapid growth.

6.3 Loss of Customer Control

Businesses typically retain control over customer relationships, even when using AR Factoring services.

Case Studies of AR Factoring

Case Study 1: XYZ Manufacturing

Industry: Manufacturing

Challenge: XYZ Manufacturing, a medium-sized manufacturing company, faced cash flow problems due to lengthy payment terms imposed by their clients. Many of their customers required 60 to 90 days to pay invoices, which hindered XYZ Manufacturing’s ability to meet operational expenses and invest in necessary equipment upgrades.

Solution:

- XYZ Manufacturing partnered with an AR Factoring Company that specialized in the manufacturing sector.

- They began submitting their outstanding invoices to the factoring company, which included invoices with payment terms of up to 90 days.

- The AR Factoring Company advanced them a significant portion of the invoice amounts, providing immediate cash injection.

- With this improved cash flow, XYZ Manufacturing was able to pay suppliers on time, fulfill new orders promptly, and enhance their manufacturing capabilities.

Results:

- XYZ Manufacturing saw a substantial improvement in cash flow, allowing them to pursue larger contracts and expand their operations.

- The hassle of managing late payments from clients was eliminated since the factoring company handled collections on their behalf.

- The company experienced accelerated growth and capitalized on new market opportunities that were previously out of reach.

Case Study 2: ABC Tech Startup

Industry: Technology Startup

Challenge: ABC Tech Startup, a rapidly growing software development company, faced cash flow issues due to irregular client payments. The unpredictability of when they would receive payments made it challenging to manage day-to-day operations and invest in critical projects.

Solution:

- ABC Tech Startup partnered with an AR Factoring Company specializing in startups and technology firms.

- They began factoring their outstanding invoices, which included payments from various clients with varying payment terms.

- The factoring company provided them with funds, often within 24 hours of invoice submission.

- This improved cash flow allowed ABC Tech Startup to hire additional talent, invest in marketing efforts, and take on multiple projects simultaneously.

Results:

- ABC Tech Startup’s growth trajectory soared thanks to the consistent cash flow provided by AR factoring.

- They no longer had to turn down lucrative projects or delay expansion plans due to financial constraints.

- The factoring company’s industry expertise helped them navigate the unique financial challenges faced by tech startups.

These case studies illustrate the significant impact that AR factoring can have on businesses across different industries. By providing immediate access to cash and managing accounts receivables efficiently, AR factoring empowers companies to overcome cash flow challenges, seize growth opportunities, and thrive in their respective sectors.

The Future of AR Factoring

8.1 Technological Advancements

The future of AR Factoring holds exciting possibilities, driven by technological advancements. Automation and digitalization are streamlining the entire process, making it quicker and more efficient for businesses. For instance, many AR Factoring Companies now offer online portals where businesses can submit invoices, track payment statuses, and access funds seamlessly.

Additionally, artificial intelligence and machine learning are being utilized to assess credit risk more accurately. This means that businesses can expect even faster approval processes and more competitive rates. With the integration of cutting-edge technology, the AR Factoring landscape is becoming increasingly user-friendly and accessible.

8.2 Market Trends

Keeping an eye on market trends is essential for businesses considering AR Factoring. As the global economy evolves, so do the needs of businesses. AR Factoring is no longer confined to traditional sectors; it has expanded to include e-commerce, technology startups, and various service industries. Understanding these trends can help businesses stay competitive and make informed decisions about their financial strategy.

Additionally, sustainability and ethical business practices are gaining prominence. Some AR Factoring Companies are aligning themselves with environmentally and socially responsible initiatives. This means that businesses may have the option to work with factoring partners who share their values, contributing to a more sustainable and responsible financial ecosystem.

8.3 Expanding Horizons

AR Factoring is not bound by geographical limitations. While it has traditionally been associated with North America and Europe, it’s gaining traction in emerging markets as well. Businesses operating globally can leverage AR Factoring to manage their cash flow and overcome the challenges posed by varying payment cycles and currency fluctuations.

Moreover, AR Factoring is not limited to a single industry. Whether you’re in manufacturing, healthcare, construction, or any other sector, there’s likely an AR Factoring solution tailored to your specific needs. Exploring these expanding horizons can open up new avenues for businesses looking to secure their financial future.

AR Factoring Companies